- 24-Apr-2024

Latest news

-

- Market Watch

- 24-Apr-2024 22:50

Tristan Capital in dispute over clawback of interim promote payments

The downside to American private equity-style 'interim' bonus payments at investment funds is being graphically demonstrated in a hushed-up case involving London-based real estate company, Tristan Capital Partners. It might even make professionals question signing such performance-related contracts.

-

- Living Watch

- 24-Apr-2024 16:31

Listed ground rents company sees valuation downgrade

A UK-focused closed ended real estate investment trust that collects ground rents from residential property has revealed that Savills has marked down the value of its portfolio from £110 mln (€127 mln) to £81 mln in the space of a year.

-

- Capital Watch

- 24-Apr-2024 13:54

Will capital raising recover in 2024?

INREV’s Capital Raising Survey, which finds that capital raising activity in 2023 was the lowest volume of capital raised since 2015, will make the industry wonder whether this aspect of real estate will recover this year.

-

- Finance Watch

- 24-Apr-2024 13:16

Cheyne provides senior loan to KSL Capital for Sereno Hotels deal

Global alternative asset manager Cheyne Capital has provided a cross-jurisdiction senior secured facility to a JV between US KSL Capital Partners and entrepreneur Luis Contreras for the acqusition of Sereno Hotels, announced last year.

-

- People Watch

- 24-Apr-2024 13:08

Klépierre hires new CFO for Italian arm

French listed shopping centre specialist Klépierre has announced the appointment of Filippo Bozzalla Cassione as new chief financial officer of its Italian business.

-

- Living Watch

- 23-Apr-2024 14:41

CDC Investissement Immobilier and Covivio link up on German residential

CDC Investissement Immobilier, the real estate asset management subsidiary of French financial institution Caisse des Dépôts, has inked a strategic partnership with Covivio in Germany.

Market Watch

-

Tristan Capital in dispute over clawback of interim promote payments

- 24-Apr-2024

The downside to American private equity-style 'interim' bonus payments at investment funds is being graphically demonstrated in a hushed-up case involving London-based real estate company, Tristan Capital Partners. It might even make professionals question signing such performance-related contracts.

-

-

- 22-Apr-2024

Allsop raises €50m in UK resi auctions

People Watch

-

Klépierre hires new CFO for Italian arm

- 24-Apr-2024

French listed shopping centre specialist Klépierre has announced the appointment of Filippo Bozzalla Cassione as new chief financial officer of its Italian business.

Best read stories

-

Bondstone allocates €70m for resi project in Portugal

- 19-Apr-2024

Portuguese real estate investor and developer Bondstone is investing around €70 mln in a residential development in Belas Clube de Campo, municipality of Sintra, Portugal.

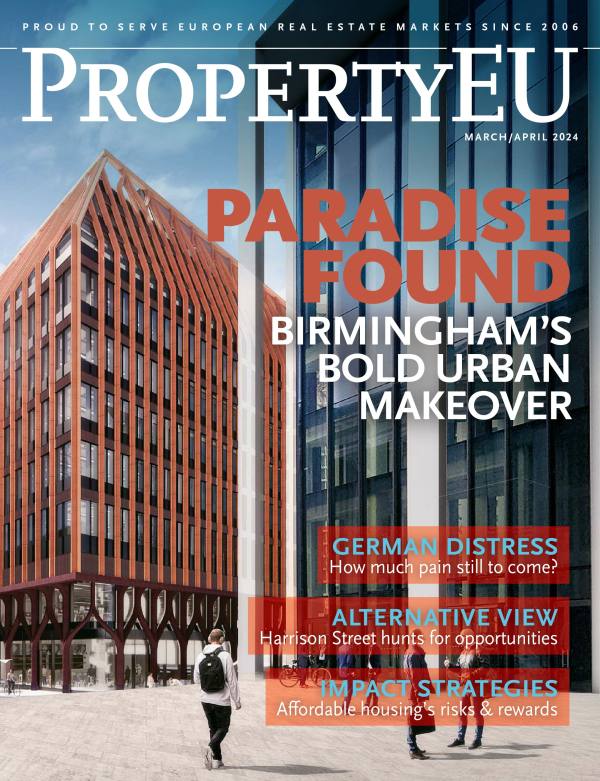

Latest magazine

Editor's Letter

-

The big geo debate

- 05-Mar-2024

With a bumper election year ahead, Robin Marriott wonders to what extent (geo)politics is shaping real estate firms' business strategies.

Magazine highlights

-

INTERVIEW: 'We like fragmented asset classes'

- 06-Mar-2024

Alternative assets investment pioneer Harrison Street plans to expand into new niche sectors in Europe this year as the market enters a 12-month window of opportunity. Paul Bashir and Josh Miller explain the firm's strategy.

-

- 05-Mar-2024

MAGAZINE: Birmingham's bold urban makeover

-

Content partners

-

Insight from MIPIM 2024: Josh Miller, Harrison Street

- 18-Mar-2024

Josh Miller, Head of Transactions - Europe for Harrison Street, caught up with PropertyEU during Mipim 2024.

PropertyTV

-

Leonie Kierkels, Realterm

MLP Group eyes further expansion in key markets

Brigit Gerritse, Redevco

;

Events

Research

-

London investment activity rises in two successive quarters - research

- 15-Apr-2024

Commercial real estate investment volumes in London have recorded two consecutive quarterly increases, according to analysis from BNP Paribas Real Estate.