- 18-apr-2024

Latest news

-

- Market Watch

- 19-apr-2024 09:50

Weekly data sheet: More sales of collapsed Signa's assets get underway

Two Berlin trophies are among the properties to be sold, with Signa's partner The Central Group buying the capital's iconic KaDeWe department store.

-

- Living Watch

- 19-apr-2024 09:23

Hanner and 1 Asset Management invest €25m in Warsaw PBSA project

Lithuanian real estate developer Hanner and asset manager 1 Asset Management are expanding their presence in Poland with another student housing project in Warsaw.

-

- Retail Watch

- 19-apr-2024 09:04

BIG Poland expands portfolio with acquisition of Warsaw retail park

BIG Poland has acquired Park Glinianka in Lubna, on the outskirts of Warsaw, from retail park developer Redkom Development for an undisclosed price.

-

- Finance Watch

- 18-apr-2024 15:41

SBB-backed PPI to raise €150 via IPO

Public Property Invest (PPI), a Norwegian commercial property firm 45%-owned by troubled property group SBB, is launching an initial public offering on the Oslo stock exchange in a bid to raise up to NOK 1.8 bn (roughly €150 mln).

-

- Living Watch

- 18-apr-2024 15:20

Ardstone targets €2b for Irish housing strategy

Privately owned European real estate investment manager Ardstone is seeking to double the size of its core, social and affordable portfolio in Ireland.

-

- Logistics Watch

- 18-apr-2024 14:20

Clarion picks up Panattoni logistics park in Germany for €75m

Clarion Partners Europe, a real estate investment fund manager specialising in logistics and industrial assets, has acquired the recently developed Panattoni Logistics Park in Voerde, Germany, for €75 mln, from Panattoni.

Market Watch

-

Weekly data sheet: More sales of collapsed Signa's assets get underway

- 19-apr-2024

Two Berlin trophies are among the properties to be sold, with Signa's partner The Central Group buying the capital's iconic KaDeWe department store.

People Watch

-

DFI elevates talent

- 17-apr-2024

Deutsche Finance International (DFI), a pan-European private equity real estate firm and affiliate of Deutsche Finance Group, has promoted three people in its London and Madrid-based teams.

-

- 17-apr-2024

CBRE’s Richard Dakin to retire

Best read stories

-

Weekly data sheet: Motel One sale's valuation is latest proof of hospitality sector roaring back

- 12-apr-2024

Morgan Stanley spin-off, Proprium, made a 20-times multiple on its €65 mln equity investment in 2007 in Motel One.

Latest magazine

Editor's Letter

-

The big geo debate

- 05-mrt-2024

With a bumper election year ahead, Robin Marriott wonders to what extent (geo)politics is shaping real estate firms' business strategies.

Magazine highlights

-

INTERVIEW: 'We like fragmented asset classes'

- 06-mrt-2024

Alternative assets investment pioneer Harrison Street plans to expand into new niche sectors in Europe this year as the market enters a 12-month window of opportunity. Paul Bashir and Josh Miller explain the firm's strategy.

-

- 05-mrt-2024

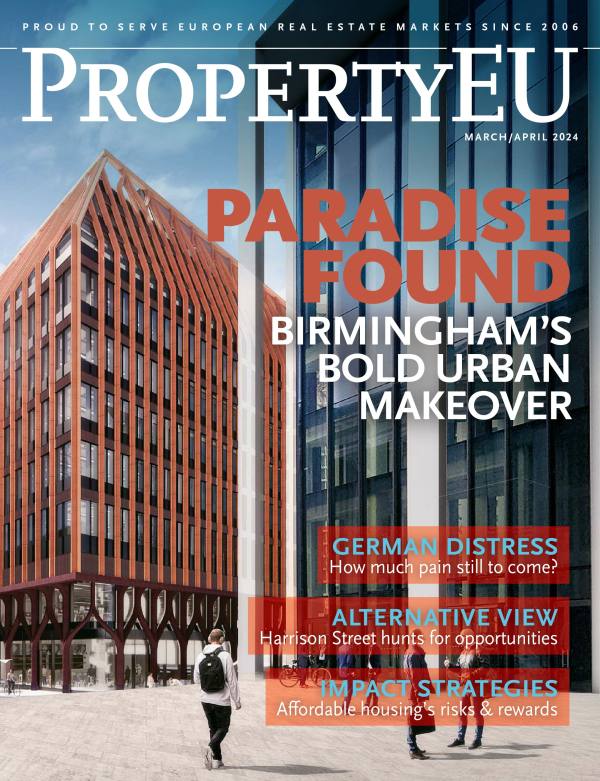

MAGAZINE: Birmingham's bold urban makeover

-

Content partners

-

Insight from MIPIM 2024: Josh Miller, Harrison Street

- 18-mrt-2024

Josh Miller, Head of Transactions - Europe for Harrison Street, caught up with PropertyEU during Mipim 2024.

PropertyTV

-

Leonie Kierkels, Realterm

MLP Group eyes further expansion in key markets

Brigit Gerritse, Redevco

;

Events

Research

-

London investment activity rises in two successive quarters - research

- 15-apr-2024

Commercial real estate investment volumes in London have recorded two consecutive quarterly increases, according to analysis from BNP Paribas Real Estate.