- 26-apr-2024

Latest news

-

- Market Watch

- 26-apr-2024 12:08

Weekly data sheet: French deal volume plunges - but French logistics buck the trend

As Ares completed a €325 mln French logistics acquisition from Blackstone, another French portfolio came onto the market.

-

- Living Watch

- 26-apr-2024 11:32

K-Fastigheter closes €94m apartment sale in Denmark

Swedish property firm K-Fastigheter has completed the sale of a portfolio comprising 311 apartments in Denmark to an unnamed institutional investor.

-

- Office Watch

- 26-apr-2024 11:24

Castellum sells €90m portfolio to fund new projects

Nordic listed property group Castellum has announced that it is selling 10 non-strategic properties for €90 mln (SEK 934 mln), in line with the carrying value.

-

- Office Watch

- 26-apr-2024 11:10

Osae Partners picks up €107m Paris asset from Deka

Osae Partners, a French independent real estate investment platform, has emerged as the buyer of the Opéra Gramont office building at 14 rue du Quatre Septembre in Paris for €107 mln.

-

- Office Watch

- 26-apr-2024 11:03

Derwent sells €90m London asset to Titan

UK REIT Derwent London has exchanged contracts to sell its 70,300 ft2 (6,530 m2) freehold interest in the Turnmill asset in London for £77 mln (€90 mln) before costs. The purchaser is the UK investment manager Titan Investors.

-

- Capital Watch

- 26-apr-2024 10:45

Swiss-based Empira pushes €550m US residential fund amid ‘megatrend’ into rentals from ownership

Empira Group, the €9bn AUM Swiss-based real estate investment company, has raised over $120 mln so far towards a $600 mln (€558 mln) fund target for a US vehicle.

Market Watch

-

Weekly data sheet: French deal volume plunges - but French logistics buck the trend

- 26-apr-2024

As Ares completed a €325 mln French logistics acquisition from Blackstone, another French portfolio came onto the market.

People Watch

-

MPC Capital selects new CEO

- 25-apr-2024

Global real assets specialist MPC Capital has appointed Constantin Baack as CEO, effective 13 June.

-

- 24-apr-2024

Klépierre hires new CFO for Italian arm

Best read stories

-

CDC Investissement Immobilier and Covivio link up on German residential

- 23-apr-2024

CDC Investissement Immobilier, the real estate asset management subsidiary of French financial institution Caisse des Dépôts, has inked a strategic partnership with Covivio in Germany.

-

-

- 23-apr-2024

Commerz Real acquires solar projects in Sweden

-

-

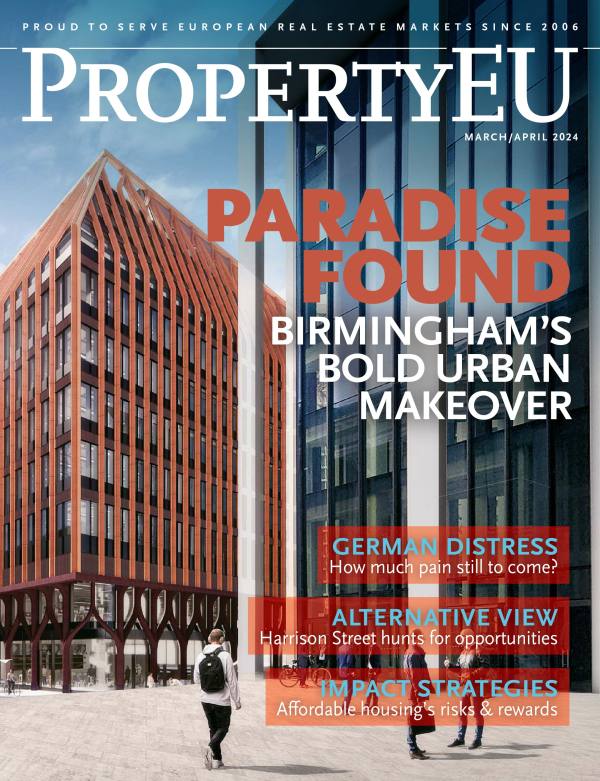

Latest magazine

Editor's Letter

-

The big geo debate

- 05-mrt-2024

With a bumper election year ahead, Robin Marriott wonders to what extent (geo)politics is shaping real estate firms' business strategies.

Magazine highlights

-

INTERVIEW: 'We like fragmented asset classes'

- 06-mrt-2024

Alternative assets investment pioneer Harrison Street plans to expand into new niche sectors in Europe this year as the market enters a 12-month window of opportunity. Paul Bashir and Josh Miller explain the firm's strategy.

-

- 05-mrt-2024

MAGAZINE: Birmingham's bold urban makeover

-

Content partners

-

Insight from MIPIM 2024: Josh Miller, Harrison Street

- 18-mrt-2024

Josh Miller, Head of Transactions - Europe for Harrison Street, caught up with PropertyEU during Mipim 2024.

PropertyTV

-

Leonie Kierkels, Realterm

MLP Group eyes further expansion in key markets

Brigit Gerritse, Redevco

;

Events

Research

-

Golden Triangle life sciences take-up increases 25% year-on-year - research

- 25-apr-2024

Life sciences take-up in the UK’s 'golden triangle' of London, Oxford and Cambridge was 186,000 ft2 (17,300 m2) ft in the first quarter of 2024, according to new research from Knight Frank.